Guardian Joint Life ITC Policy

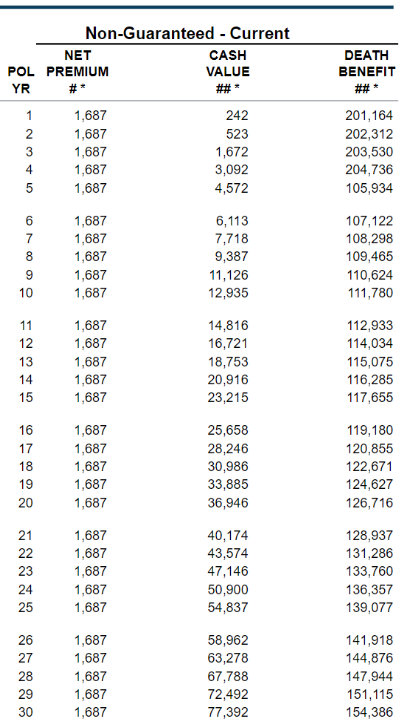

I want to give you an example of why the why the Joint Whole Life Insurance policy with LTC Rider is the cheapest option to exempt out of the WA LTC payroll tax. It ONLY pays out when the 2nd person eventually passes away. Each person has their separate $45,000 pool of LTC funds to use up to 4% (which is up to $1,800 per month until the funds are used up). If both people eventually use up their LTC pool of funds, the policy would have an additional $10,000 of Life Insurance. However, with Whole Life Insurance the policy value grows over time and eventually it would have enough cash to naturally stop needing to make the annual payment (see example charts all below). Since Guardian does not issue many of these policies they ONLY allow paper applications which takes slightly longer to get submitted. Please work with us to get all the physical signatures and email back the paperwork. Can call/text 425-802-2783 or health@achieve-alpha.com

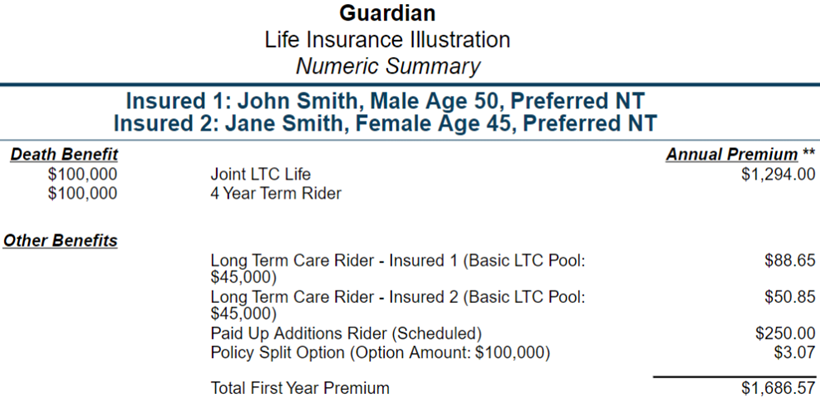

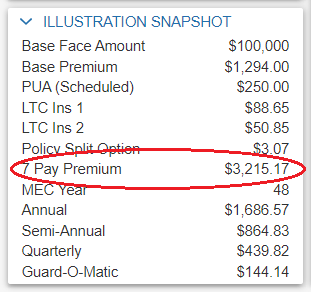

EXAMPLE: For a man age 50 and woman age 45 in good health, it would be $1,686.57 per year for the rest of their lives for a $100,000 Whole Life Policy (with each person getting a separate $45,000 LTC pool of money, so $45k LTC + $45k LTC +$10k life ins only = $100K). That’s a very long time to make payments. So they have an additional option of doing the 7-Pay Option of $3,215.17 for 7-years and be done (which is a smarter option in the long run). The good news is that if you only want to contribute the base minimum the first few years you can put in more in future years to “Pay it up” later, or continue making the minimum payment. It is very flexible and truly up to you.

If a 50-year old man were to get his own $100,000 Whole Life Policy with a $75,000 LTC pool it would be $2,142 per year. For a 45-year old woman it would be $1,544 per year with a $75,000 LTC pool. Combined it would be $3,686 if they separately got a $100,000 policy. However, this is also a total of $200,000 of Life Insurance and they both get a $75,000 pool of LTC funds instead of $100,000 combined life insurance with a $45,000 pool of LTC funds for each person. We are mainly proposing the Joint Life 2nd to Die policy as a way to get the cheapest option to exempt both husband and wife out of the WA LTC tax. It’s not magic.

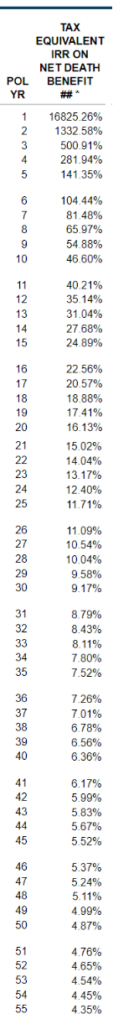

INTERNAL RATE OF RETURN (IRR): For those of you that are analytical like myself want to know what the IRR would be scroll all the way to the bottom. For Whole Life the real reason the polices actually work is that the money grows tax free and pays out tax free, which is a great benefit. The Tax Free Internal Rate of Return (IRR) is listed for this couple. Lets say they have the policy for 35 years without using any funds and both pass away (man age 85 and woman age 80) the IRR would be 7.52% over the life time of owning the policy. That’s a lot better than most low risk investments. Yet if they use ANY of the $45,000 LTC pool of funds are used during their life, the Real IRR would be much higher (as they got to use the funds much earlier than year 30 in this example). Just wanted to show these policies really do have a solid rate of return in real life. Achieve Alpha

Let us know if you have any questions or want to get one of these policies started at 425-802-2783 (call or text).

NOTE: As we get closer to the Nov 1st deadline we cannot guarantee it will get issued in time or the Temporary Insurance Agreement (making an initial payment starts the policy the date of application as long as you would have been insurable) will satisfy the requirement if your policy is not issued before Nov 1st (yet several parties have told us it will, we don’t make the rules, yet try to comply as effectively as possible). It generally takes a month or maybe up to two months to get these policies through do to the increased frenzy of applications the life insurance carriers were not anticipating. We will do our best to help you get your policy set up as quickly as possible to exempt out of this WA LTC payroll tax. What we can promise is to help get applications processed as quickly as we can!

Gary Franke, Tamara Chandler & Julia Phipps

Achieve Alpha Insurance LLC

Independent Broker

12505 Bel-Red Rd, Ste 106 Bellevue, WA 98005

425-802-2783 (call or text office line)

health@achieve-alpha.com

www.achieve-alpha.com