Those of us that live in the Seattle area don’t carry an umbrella around, even through it rains all the time. Most of the time the rain is just a drizzle or not bad enough to need it until a rare downpour. Insurance is the same way. An umbrella is an important insurance coverage most people should have with the hope you never have to use it. If you cause a major auto accident (severely injure or kill someone, you are personally responsible for their medical bills and lost future wages). Generally up to 25% of your wages can be garnished for up to 20 years in Washington State (if you cause an accident from a DUI or criminal act even a bankruptcy most likely won’t clear your judgment balance, yikes). For those that buy auto insurance you should also get an umbrella policy on top of your base coverage. The good news is that most $1,000,000 umbrella policies are about $200 to $400 per year on top of your other insurance. Let’s show you how it works.

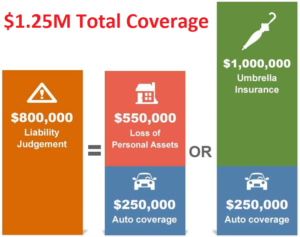

To qualify for umbrella insurance your auto liability levels must be $250,000/$500,000 for bodily injury and $100,000 for property damage. For example, if your regular auto policy had bodily injury liability coverage up to $250,000 per incident, it would jump to $1.25 million with a $1 million umbrella policy. In the example to the left, you can see this person has a $800,000 liability legal judgement against them. The umbrella policy would more than cover this, otherwise if you only had $250,000 auto insurance limit you would personally be required to pay off the $550,000 (or wages garnished until it is paid off).

What about the legal expenses you’ll incur if you’re sued? With umbrella policies, legal expenses are covered on top of the policy amount. The policy may also pay you if your appearance at legal proceedings causes you to lose pay from work (for example, if you are an hourly employee or if you don’t have any personal or vacation days available). Since the insurance company’s money is at risk when you’re sued, they will want to protect that money with its own legal team, possibly a better legal team than you could afford on your own.

Most umbrella policies often offer WORLDWIDE COVERAGE in contrast to underlying policies. Auto liability coverage abroad: The umbrella provides primary coverage for bodily injury and property damage liability when the insured rents cars outside the underlying auto policy’s territory, which is the United States, Puerto Rico, and Canada. The territory of most personal umbrellas is worldwide.

While umbrellas are a must for anyone who has accumulated high-value assets, your current net worth isn’t the only predictor of whether or not you need extra liability insurance. Your risk of being sued (and potentially facing property liens or wage garnishment if a judgment exceeds your regular policy’s limits) increases if you:

- travel or entertain a lot

- host frequent playtime for neighborhood children

- live in a condo or apartment, where a flood or fire in your home could damage neighboring units

- serve on a volunteer board (without directors’ insurance)

- expect an inheritance someday

- have high earning potential, even if you’re early in your career now

Libel & Slander

- Example: Your client posts a negative review of a business, and the business is now suing your client for libel

- Umbrella policies often offer Personal Offense Coverage that could protect your client, it can also provide financial protection against defamation of character, wrongful imprisonment, invasion of privacy and defamation of character taking place in your home. Such a policy can also help cover your defense costs in the case of a lawsuit.

Pets and Animal Claims:

- Example: Your client’s new puppy bounds out of the house and crashes into their elderly neighbor. They’ve broken their hip, resulting in surgery and long-term care. The neighbor sues your client for compensation.

- According to the Insurance Journal, dog bite and other dog-related injuries accounted for more than $700M in liability claims paid in 2017, and the increase per claim nationally has risen more than 90% since 2003 to 2017 due to the increased medical costs and size of settlements. Homeowners, renters, or condo coverage is your first defense in protecting your assets if a pet or animal claim happens, but if costs exceed your underlying policy, an umbrella policy will offer extended protection for your client.

Hosting Parties at Home:

- Example: Your client hosts a birthday party for their teenager. They did not provide any alcohol, but some of the underage guests brought some to the party. On the way home, one of the underage guests was severely injured in an auto accident. The accident was attributed to his consumption of the alcohol at the client’s home.

- Umbrella coverage could provide the client with protection in the event of this and other social host liability claims.

I like to advise having an umbrella policy is basically like having a legal defense team in your back-pocket. – If someone sues you, you typically must pay lawyer fees and processing expenses. These costs can quickly add up, even totaling hundreds of thousands of dollars for a single trial. Umbrella coverage can step in to pay these fees as you defend yourself in court.

If you are found at fault, the remainder of umbrella coverage not used for defense costs may then help pay for the associated liability expense you owe.

Here is a great Safeco Insurance overview (only one of the 14 auto insurance carriers we have access to).

If you have any questions or want to find out more about getting an umbrella policy give us a call.

- Auto & Home Insurance (14 companies)

- Health Insurance (Every company in Washington State)

- Life Insurance (33 companies)

Gary Franke, Julia Phipps & Tamara Chandler

Independent Broker

12505 Bel-Red Rd, Ste 106,

Bellevue WA 98005

425-802-2783

gfranke@basinpacific.com