Is a Cost-Share (also called Health-Share) plan a good fit for you? Lets go over how they work before you sign up. If you are looking for individual health coverage it can be extremely expensive, especially if you do not get tax credits on a traditional ACA plan. There are some alternative options, which I will go over the advantages and disadvantages in detail.

Is a Cost-Share (also called Health-Share) plan a good fit for you? Lets go over how they work before you sign up. If you are looking for individual health coverage it can be extremely expensive, especially if you do not get tax credits on a traditional ACA plan. There are some alternative options, which I will go over the advantages and disadvantages in detail.

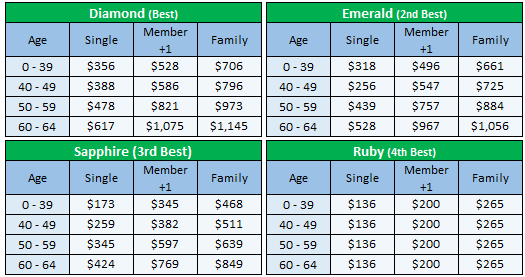

If you are healthy, a Cost-Share plan may be a good option. They are lower cost since they do not cover prior health issues, so for someone with ongoing or current potential health issues do not purchase one of these plans, they will not cover any of your current medical issues. The main reason Cost-Share work well for those that are currently healthy is that they are priced for only covering new medical issues that would arise for you after you start a plan. However, there is a waiting period for most health issues you currently have such as two or five years. This is a more detailed list of waiting periods. Cost-share plans can be up to 65% cheaper than traditional ACA comprehensive plans. This is better than no coverage at all, yet do not encourage buying a plan unless you have gone over for how cost-share plans work. In the long run for those that are healthy this is a good way to save money, then if you do start having health issues you can always move to a traditional comprehensive ACA type plan only during the open enrollment period, which is every year from November 1st to December 15th. The network for the Altrua Cost-Share plan that we represent has a very broad PHCS/Multiplan network of doctors. You can enroll in a Cost-Share plan in any state, and same pricing throughout the entire United States. This is a good nationwide network of doctors, urgent care and hospital systems. Always try to stay in-network as your share will be lower. If you ever have a true major medical issue seek treatment immediately wherever you are able to. You can purchase a cost-share plan any month since they don’t cover prior health issues. This is the link to the entire Altrua 2020 Membership. Since the Cost-Share plans do not cover cancer in the first 90-days or 12-months (depending on which plan you choose) we recommend to get a Cancer Plan and Accident Plan. Also if you travel outside the USA we strongly recommend to buy a Travel Plan (here), as cost-share plans only provide coverage in the United States. The Altrua cost-share plans are NOT Health Insurance and do NOT cover any pre-existing conditions. If you have any health issues do not purchase this plan! You have been warned.

ENROLL IN ALTRUA COST-SHARE PLAN HERE

We recommend to scroll down and check out the coverage details on which plan best fits your needs. If you have questions or help enrolling give us a call at 425-802-2783 or health@achieve-alpha.com. Yes there is coverage for COVID-19 related testing and other medical expenses with an Altrua plan. However, if you have COVID-19 before the plan starts it would not be covered like any other pre-existing condition. Download the Altrua App on your phone for easier use of your membership benefits here: altruahealthshare.org/app.

- There is an additional monthly charge if you are above the “height/weight limits”. Click on the link below.

- If a membership has more than 5 dependents, an additional monthly contribution of $50 is required for each additional dependent.

- $50 for each additional Copper member.

- Head of Household is the oldest member in the household.

Height & Weight Additional Monthly Cost

If you are above the yellow line on the Height/Weight chart you can get coverage now starting in 2020. However, any medical treatment for obese is not covered. This outline is an overview, please refer to website for exact policy details.

- $100.00 Annual Non-Refundable Membership fee, yet is waived if purchase a plan before 1/31/2020, just enter save100

- $25.00 P One time Non-Refundable Donation to Altrua Ministries

- Look up Doctors at altruahealthshare.org. Click on the ‘Resources’ tab located on the top section, then click ‘affiliated providers’.

Statement of Standards I agree to live a clean and healthy lifestyle and I share the following ethical or religious beliefs:

- I believe in caring for one another.

- I believe in keeping my body clean and healthy with proper nutrition.

- I believe that excessive alcohol consumption, as well as the use of tobacco or illicit drugs, is harmful to the body and soul.

- I believe sexual relations outside the bond of marriage is contrary to the teachings of the Bible and that marriage should be held in honor.

- I believe abortion is wrong, except in a life-threatening situation for the mother.

- We care for our families and physical, mental or emotional abuse of any kind to a family member or anyone else is morally wrong.

NOTE: If you use any tobacco products in any form, use marijuana, or illicit drugs you are not allowed to purchase this plan. Specialist Visits and Urgent Care Facilities Diamond and Emerald membership plan members submit a $35 MRA to the licensed medical professional, and the membership will share up to $300 per eligible visit on the member’s behalf. Office visit MRAs are not applied to the 1st or 2nd MRA. Urgent care visits are eligible for sharing under the office visit MRA. Members are allowed six (combined) office, specialist, or urgent care visits each calendar year. If you exceed six office visits in a calendar year, you will be responsible for any charges you incur for the additional visits. These additional visits will not be applied to satisfy your 1st then 2nd MRA, and these charges are ineligible for sharing. The medical needs below require pre-authorization and are ineligible for sharing within the first 90 days of your membership effective date unless the treatment or services were performed during an eligible emergency room visit for an accidental injury, life-threatening symptom(s), or eligible surgery that has occurred after the effective date. List of procedures not covered in first 90 days (unless done as part of being admitted through the Emergency Room that is a covered event). Yes, this is very confusing, see the manual for additional information:

- Advanced imaging (for example, MRI, MRA, CT, or PET scans. Advanced imaging does not apply to routine mammogram screening), Bone density scans, Cardiac testing, procedures and treatments, EGD (upper endoscopy) procedures, EMG/EEG tests, Infusion therapy, In-office procedures (e.g., joint injection, skin biopsy), Inpatient hospital admissions (unless admitted through ER), Long term care—any and all treatments involved, Nuclide studies, Ophthalmic surgical procedures, Outpatient surgery, testing, and procedures (including pre-admission testing), Sleep studies, Ultrasound scans (does not apply to maternity or routine mammograms)

To receive a pre-authorization number, ask your provider to call the phone number on the back of your current member ID card. Failure to provide a pre-authorization number when processing these medical needs will render them ineligible for sharing. Ineligible medical needs related to your Membership Enrollment Application:

- Any illness, injury, or condition for which there is a membership limitation indicated on the Membership Enrollment Application

- Any illness, injury or condition (or associated medical needs) for which you are aware of, but fail to disclose on your Membership Enrollment Application

Medical needs that require a waiting period for eligibility: Not eligible in the first 12 months:

- Any cancer diagnosis, pre-cancerous testing (except for mammograms, pap smears, and PSA tests), or cancer treatment within the first 12 months of your membership effective date. Starting on 1/1/2020, if you purchase a Diamond or Emerald plan there is only a 90-day waiting period for cancer.

- Chiropractic care within the first 12 months of your membership effective date

- Occupational, physical therapy and speech therapy (unless it’s associated with an eligible surgery or eligible accidental injury) within the first 12 months of your membership effective date

- Cataracts and/or glaucoma diagnostic testing or surgery within the first 12 months of your membership effective date

- Any medical needs regarding the female reproductive system, resulting from post-menopausal symptoms or complications will not be eligible within the first 12 months of your membership effective date

- Alternative medicine within the first 12 months of your membership effective date

Maternity Must not be pregnant before starting coverage. Sharing for maternity needs has a 90-day waiting period, subject to membership plan. INELIGIBLE MEDICAL NEEDS RELATING TO MATERNITY:

- Circumcisions resulting from an ineligible maternity (being pregnant before plan start date, 90-day waiting period)

- Congenital birth defects for anyone not born under an eligible maternity

Keep reading below for additional information about the cost share plans.

Medical Questions

- Do you (or any applicant in your family) currently have any of the following conditions? Alzheimer’s Disease Autism Spectrum Disorders Cancer Cerebral Palsy Cholera Chronic Kidney Disease Chronic Obstructive Pulmonary Disease Cystic Fibrosis Dementia Diabetes Type I Down’s Syndrome Emphysema Fragile X Syndrome Hepatitis (Chronic Viral B & C) HIV/AIDS Lyme’s Disease Muscular Dystrophy Parkinson’s Disease Schizophrenia, Paranoia, or Psychosis Sickle-Cell Disease Spina Bifida Typhoid

- Have you (or any applicant in your family) used illegal drugs within the last 12 months? Yes or No?

- Have you (or any applicant in your family) used tobacco or nicotine related products (i.e. vapor, e-cigarettes, chewing tobacco, cigars) within the last 12 months?

- Is anyone applying currently pregnant or suspect they may be?

- Do you (or any applicants) currently undergo immunotherapy treatment for allergies?

- Have you (or any applicant in your family) been diagnosed with a mental illness or condition (i.e. depression, anxiety, bi-polar disorder)?

- Have you (or any applicants) been diagnosed with any of the below within the last 10 years? Auto Immune Disease Cancer Condition or Disease of the circulatory system Condition or Disease of the Musculoskeletal System Condition or Disease relating to the reproductive or urinary systems Digestive system condition or Disease Disease or Condition relating to the nervous system or sense organs Endocrine or Metabolic Disorder Eye condition or Disease Infectious or Parasitic Disease Migraines Nutritional deficiency Respiratory condition or Disease Skin Condition or Disease Tumor or Abnormal benign growth Type II Diabetes None of the above

- Do you (or any applicant) currently have an implant/hardware, prosthesis, or monitoring device? If so, which type?

- Have you (or any applicant) had a surgical operation within the last 10 years? Please do not include tonsil removal, adenoid removal, gallbladder removal, or appendix removal or any surgeries related to a cancer diagnosis?

No diagnosis or treatment of any cancer is shared in during the first 12 months of membership Eligibility for Primary Cancer Needs: In order for needs related to the following cancer diagnosis to be eligible:

- Prostate Breast Cervical Endometrial and Ovarian Cancers Female members are 40 and over are required to get screening tests every two years from the date of the last negative result, while on the membership: mammogram, or ultrasound in place of mammogram, and pap-smear with pelvic exams for female members.

- Male members, age 50 and over, are required to get a PSA blood test every two years from the date of last negative test result. Failure to obtain the biennial tests will render future needs listed above as ineligible. The biennial tests must be performed within 24 months of their last clean test result and submitted to Altrua HealthShare.

- For new members, the aforementioned cancers will be eligible for sharing 12 months after the receipt of clean test results Altrua HealthShare within 30 days from the member’s effective date. If the new member does not submit the clean test results within 30 davs the aforementioned cancer will be eligible for sharing 12 months from the date the clean test results were received by Altrua HealthShare.

Question on application-Have you been diagnosed with any of the following conditions in the past 10 Years? Per Crown Administrators if diagnoses was 11 years ago or more, you are not required to report pre-existing condition on application. In training presentation trainer said that if you are new to the plan then you must submit a clean test that was completed no more than 6 months prior to start date or the “12-month” clock will not start until you submit the results of the appropriate test. CONTACT ALTRUA: This is the link to click when you need to file a claim, update address, update payment method or any other online submission form you will need.