This is an overview of the Cascade Bronze Plan you purchased. This plan design is the same for every insurance carrier, yet they each have their own network for all medical services. This way you can compare apples to apples for the doctors, hospital networks, prescription drugs and other items of importance to you.  We generally find that someone who purchases a Cascade Bronze plan is planning to have a minimal medical expense and mainly looking for catastrophic coverage to protect from a major emergency. Usually someone sees the doctor less often, has only a few cheaper generic prescriptions or has minimal ongoing medical conditions. Each person in a household can buy their own plan. Often, we have one member that buys a Bronzer plan that needs minimal medical coverage and the other family members get a Gold or Silver plan because they need more medical services. Here are some highlights in the Cascade Bronze Plan:

We generally find that someone who purchases a Cascade Bronze plan is planning to have a minimal medical expense and mainly looking for catastrophic coverage to protect from a major emergency. Usually someone sees the doctor less often, has only a few cheaper generic prescriptions or has minimal ongoing medical conditions. Each person in a household can buy their own plan. Often, we have one member that buys a Bronzer plan that needs minimal medical coverage and the other family members get a Gold or Silver plan because they need more medical services. Here are some highlights in the Cascade Bronze Plan:

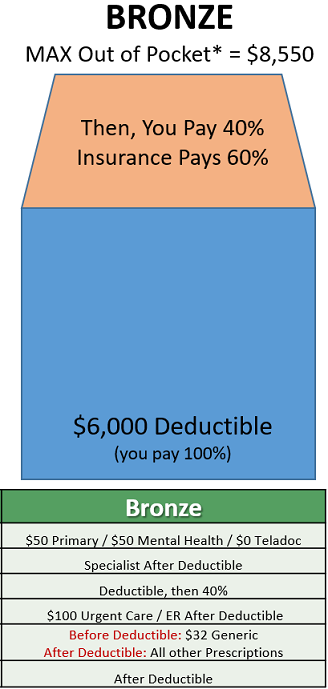

- Prescription Drugs. Covers Generic Drugs for $32/mo (often it can be cheaper to pay cash instead of using insurance yet keep your receipt. It can be applied to your Max Out of Pocket later).

- Coverage BEFORE Deductible: Below in the Green & Grey section you can see what flat copays are covered for; $50 for doctor visits and $100 for urgent care. All other doctors’ visits such as a specialist doctor, bloodwork, and brand name prescription drugs are covered AFTER deductible. This plan is much cheaper than Gold and Silver plans for a reason. All plans cover a max of 10 chiropractor and 12 acupuncture visits per calendar year.

This image is a summary of the benefits, we find that for most people it’s easier to understand how the plan works by looking at an image of the plan benefits (easier than a spreadsheet). Here’s a real-life example with the Cascade Bronze Plan: If you are expecting to have a $10,000 surgery (or a $10,000 medical expense), you would likely pay about $7,500 in medical expenses (it could be lower due to copays). Once you hit the $8,550 max out of pocket for the year in-network or true emergency, then your insurance carrier will pay 100% of your medical expenses that are approved as medically necessary.

NOTE: You will need to set up auto pay from a personal checking account separately for each plan, even if you each choose the same insurance carrier. If you have any additional questions please let us know, we also recommend setting up a login at your insurance carrier’s website. Within the client portal there are a variety of resources: you can print temporary ID cards, review your claims, change your primary care provider, and find details about your benefits.

Gary Franke & Tamara Chandler

Independent Broker

Achieve Alpha Insurance LLC

12505 Bel-Red Rd, Ste 106

Bellevue, WA 98005

425-802-2783 (call or text office line)

health@achieve-alpha.com

www.achieve-alpha.com