This is an overview of the Cascade Silver Plan you purchased. This plan design is the same for every insurance carrier, yet they each have their own network for all medical services. This way you can compare apples to apples for the doctors, hospital networks, prescription drugs and other items of importance to you.  We generally find that someone who purchases a Cascade Silver plan is planning to have a moderate amount of major medical expenses. Someone that likes predictability in their health insurance, sees the doctor more often, has several expensive prescriptions or has ongoing bloodwork needed (such as someone that is diabetic). Each person in a household can buy their own plan. Often, we have one member that buys a Silver plan that needs more medical services and the other family members get a Bronze because they need fewer services. The Cascade Silver plan benefits may adjust as your income goes up or down. So be careful when updating income in the WA Exchange if prompted. Here are some highlights in the Cascade Silver Plan:

We generally find that someone who purchases a Cascade Silver plan is planning to have a moderate amount of major medical expenses. Someone that likes predictability in their health insurance, sees the doctor more often, has several expensive prescriptions or has ongoing bloodwork needed (such as someone that is diabetic). Each person in a household can buy their own plan. Often, we have one member that buys a Silver plan that needs more medical services and the other family members get a Bronze because they need fewer services. The Cascade Silver plan benefits may adjust as your income goes up or down. So be careful when updating income in the WA Exchange if prompted. Here are some highlights in the Cascade Silver Plan:

- Prescription Drugs. If you have a Tier 3 or Tier 4 drug it can be often be $500/mo to $5,000/mo. With this plan it is a flat $250 per month (as long as the prescription is included on that insurance carriers drug formulary list, which is very important to double check first).

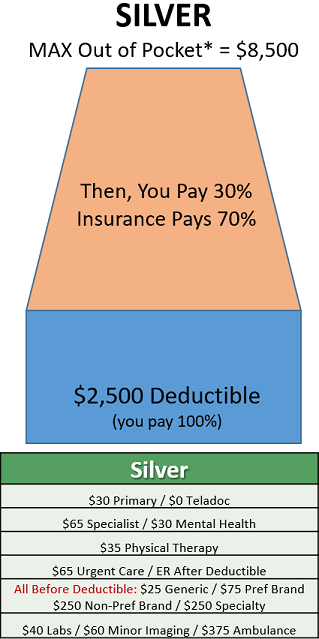

- Coverage BEFORE Deductible: Below in the Green & Grey section you can see what flat copays are covered for; $30 for doctor visits, $65 specialist doctors, $35 for physical therapy (up to 25 visits), up to $250 for prescriptions, $40 for lab or bloodwork and $60 for minor imaging like an X-Ray and $375 for an Ambulance are services covered before the deductible. All plans cover a max of 10 chiropractor and 12 acupuncture visits per calendar year.

This image is a summary of the benefits, we find that for most people it’s easier to understand how the plan works by looking at an image of the plan benefits (easier than a spreadsheet). Here’s a real-life example with the Cascade Silver Plan: If you are expecting to have a $10,000 surgery (or a $10,000 medical expense), you would likely pay about $4,700 in medical expenses (it could be lower due to copays). Once you hit the $8,500 max out of pocket for the year in-network or true emergency, then your insurance carrier will pay 100% of your medical expenses that are approved as medically necessary.

NOTE: You will need to set up auto pay from a personal checking account separately for each plan, even if you each choose the same insurance carrier. If you have any additional questions, please let us know, we also recommend setting up a login at your insurance carrier’s website. Within the client portal there are a variety of resources: you can print temporary ID cards, review your claims, change your primary care provider, and find details about your benefits.

Gary Franke & Tamara Chandler

Independent Broker

Achieve Alpha Insurance LLC

12505 Bel-Red Rd, Ste 106

Bellevue, WA 98005

425-802-2783 (call or text office line)

health@achieve-alpha.com

www.achieve-alpha.com