When you are looking into individual health insurance through the WA HealthPlanFinder there are many options for plans. If you ever wondered how tax credits are calculated we are here to help. Depending on your income you may qualify for tax credits (which you can get up front to reduce your monthly cost). The way tax credits are calculated is based on your income and seems like a complex random algorithm. The good news is that there is a method to how they work. We have it all dialed in with an entire spreadsheet if you reach out to us to help guide you.

When you are looking into individual health insurance through the WA HealthPlanFinder there are many options for plans. If you ever wondered how tax credits are calculated we are here to help. Depending on your income you may qualify for tax credits (which you can get up front to reduce your monthly cost). The way tax credits are calculated is based on your income and seems like a complex random algorithm. The good news is that there is a method to how they work. We have it all dialed in with an entire spreadsheet if you reach out to us to help guide you.

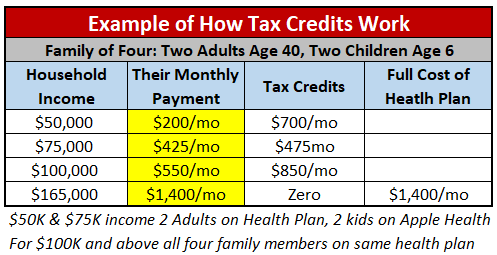

Tax credits are based on 8.5% of your Modified Adjusted Gross Income (MAGI) for the second cheapest silver plan in your county. This takes into account all taxable income for the year you are in now, not the prior tax return year. So you will have to estimate what you think you will be earning. In mid-January of the next year you will get a 1095-A form from the WA Exchange. Give this to your accountant and they will calculate what you should have gotten. If you put in you estimated making $70,000 and make $100,000 you are going to owe some of the tax credits back. If you make $50,000 you would have gotten more tax credits and will get a refund. You can’t game the system and will pay the same amount eventually at the end of the year. The amount of tax credits you qualify for stays the same no matter which plan you choose.

Below are a few examples of Income levels to give you context. Essentially if you make more you pay more. If you make less you pay less.

Our areas of expertise are:

Gary Franke & Tamara Chandler

Achieve Alpha Insurance LLC

Independent Broker

12505 Bel-Red Rd, Ste 106

Bellevue, WA 98005

425-802-2783 (call or text office line)

health@achieve-alpha.com

www.achieve-alpha.com