Overview of Open Enrollment for 2023 with Carrier Details

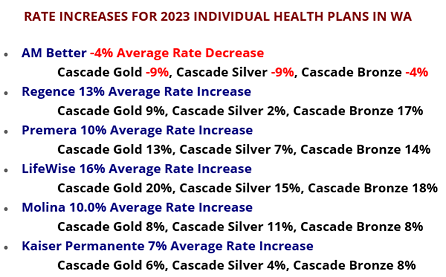

It’s that time of year again… Open Enrollment for individual health insurance is from Nov 1st to Dec 15th for a January 1st, 2023, start date. This is when you find out how much inflation is going to hit your pocketbook for health insurance costs. There is some good news, the average increase is about 10% next year. The only carrier to lower prices is AM Better. If you are getting tax credits, they are calculated based on the 2nd cheapest Silver plan, so it is an algorithm of who is raising prices (so you may not see a full 10% increase in monthly cost). Keep scrolling down for more information on the carriers who have the most changes. Also, be aware that the find a doctor and find a prescription function on the WA Exchange is very unreliable. Make sure to look up your providers and prescriptions on the carrier websites. If your income has increased for the rest of 2022 and project for 2023 ONLY update the WA Exchange after Nov 16th, otherwise it may impact your benefits if you are on a silver plan (message us if you have questions).

Every year I create a comprehensive YouTube video of individual health insurance for the next year (this will be updated on Monday Oct 17th, so come back if you see this before that date). I will be recording this 10-minute overview of plans and the carrier networks to help give you an idea of your options. This will hopefully answer most of your questions. If you do have questions, you can schedule a time with Gary or Tamara on our calendars here. You can also reach us at 425-802-2783 (call or text) or email health@achieve-alpha.com.

Every year I create a comprehensive YouTube video of individual health insurance for the next year (this will be updated on Monday Oct 17th, so come back if you see this before that date). I will be recording this 10-minute overview of plans and the carrier networks to help give you an idea of your options. This will hopefully answer most of your questions. If you do have questions, you can schedule a time with Gary or Tamara on our calendars here. You can also reach us at 425-802-2783 (call or text) or email health@achieve-alpha.com.

Individual Health Insurance in WA (Overview of Carriers Websites) Use this link to look up your specific Health Insurance Carrier contact information for (Regence, AM Better, Premera, LifeWise, Molina, United Healthcare and Kaiser Permanente).

SUMMARY OF HEALTH CARRIER CHANGES: The health carriers for 2023 are not changing their hospital networks, yet there are always some changes to doctor networks and prescriptions covered by carriers. However, there are some important changes occurring on a plan-by-plan level. The WA Exchange is making carriers reduce the number of plans they offer on the Exchange. Please watch for communication. If your plan is being discontinued, you will see in the communication from the WA Exchange with information about your new plan for 2023. I’m okay with this since many of the plans they offered are redundant.

AM Better: The average plan is decreasing by 4% with AM Better and they are going to be the cheapest plan by carrier in most counties for 2023. If you want to save money, this is likely the carrier for you. They do have a moderate network of independent doctors and a small network of mental health providers, so if you have a specific provider look up to see if they are in this network. In the last several years the AM Better network has expanded significantly. They also have In-Network coverage in 24 other states. For those of you that live or plan on traveling for any length of time to AZ, TX, FL, or most states in the south or east coast this will give you comfort to have the ability to schedule appointments with doctors in other states. The AM Better Rewards program is robust and can get up to $500 per family member for doing the healthy living program (only available for AM Better clients). They generally have great customer service.

Regence: The average plan is increasing by 13%, yet most other carriers have a similar rate increase. Effective immediately Proliance Surgeons are now in-network with Regence Individual & Family Network. When you are traveling across the USA, Regence (through the BlueCard Network) covers Urgent Care centers in every state. Most other carriers only cover your medical needs if you are having a medical emergency and go to an Emergency Room. Similar to AM Better, Regence has a four-state footprint where you can find In-Network providers in Oregon, Idaho and Utah. One key advantage is that their Silver plan is only increasing by 2%, however their Bronze plan is going up by 17% (yet Premera and LifeWise are going up by similar amounts). They generally have great customer service.

LifeWise: The average plan is increasing by 16%, however they are still cheaper than Premera (as LifeWise is owned by Premera). They have a large network of independent doctors, yet a smaller network of hospital systems. Generally, in the greater Seattle area it is Swedish/Providence and CHI Franciscan. They do not cover Virginia Mason yet (which is now owned by CHI). They generally have a good prescription drug formulary if you are taking a more expensive drug. They only cover Washington State for in-network providers or medical emergencies in other states.

Premera: The average plan is increasing by 10% and they are already the most expensive. The key is that they cover more doctors and hospital systems than other carriers including The Polyclinic (which only UHC covers as well). They have the best network overall, yet you pay a high price for it. If you are on a Premera plan there might be other lower cost options that still cover your providers and medical needs. They only cover Washington State for in-network providers or medical emergencies in other states.

Kaiser Permanente: The average plan is increasing by 7% and offer lower cost plans than most carriers. However, they are an HMO with most coverage at Kaiser facilities, yet in many rural counites you may be able to find in-network care within nearby hospital systems (check their website for covered providers and facilities). They have a 7-state in-network footprint, which includes Oregon, California (only carrier that does), Hawaii, Colorado, Georgia, Virginia, DC and Maryland along with medical emergencies in all other states. Some huge advantages are that you can call your Kaiser doctors, email them and often do virtual appointments instead of driving all the way into a physical office.

Molina Marketplace: The average plan is increasing by 10%. They are contracted with nearly every hospital system in Washington State (except for Virginia Mason). However, they have a small network of independent doctors and very limited network of mental health providers. They only cover Washington State for in-network providers or medical emergencies in other states. They are generally a cheaper plan for the price, yet their customer service and claims departments are very lacking in effectiveness.

United Healthcare: The average plan is increasing by 15% and their plans are slightly overpriced for the network size. They cover a moderate amount of hospital systems yet do cover The Polyclinic and The Everett Clinic. They only cover Washington State for in-network providers or medical emergencies in other states. They generally have great customer service.

Our areas of expertise are:

Gary Franke & Tamara Chandler

Achieve Alpha Insurance LLC

Independent Broker

12505 Bel-Red Rd, Ste 106

Bellevue, WA 98005

425-802-2783 (call or text office line)

health@achieve-alpha.com

www.achieve-alpha.com